About the Team

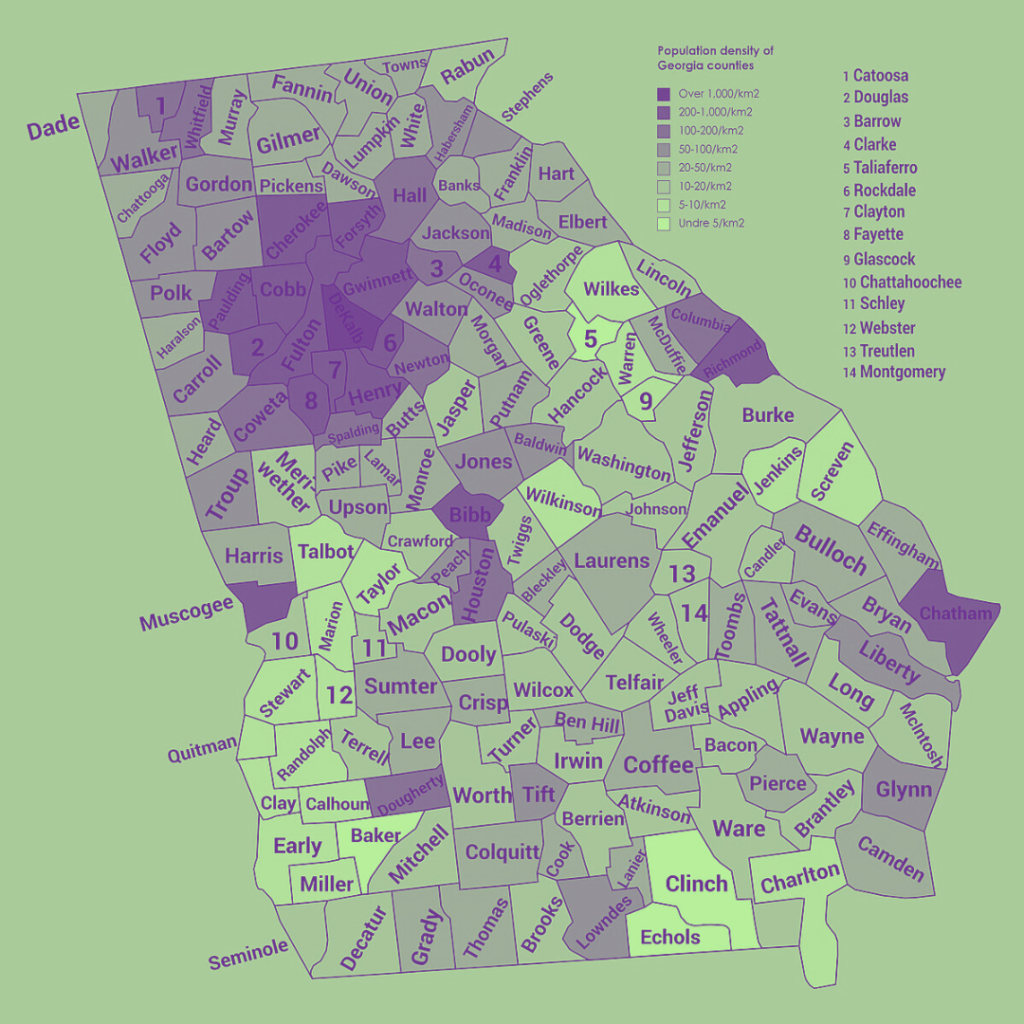

At Recoup Co, we devote our resources and expertise to advocate for hard-working Georgians who have lost their homes or property to foreclosure each year. We look forward to helping you reclaim your surplus funds efficiently and professionally.

Kaitlyn ‘Kait’ Gill

I go by Kait, I own and operate Recoup Coalition with the support of licensed Georgia attorneys and a certified public notary local to you. I’m the (only) Lead Auditor & People Finder at Recoup Coalition with 4 years of contract and property research experience in the timeshare industry.

I am passionate about finding loopholes in the system to benefit individuals and dedicated to making the world a better place for as many people as possible. It is an unfortunate reality that money is power, Recoup Co is my way of returning a bit of that power to the ones who it was taken from.

Contact us today to start the process of reclaiming what is rightfully yours!

Frequently Asked Questions

How am I owed money?

Even properties that have been paid off can be foreclosed upon due to unpaid property taxes or other liens.

The county where the home resides organizes the auction, with the starting bid opening at the taxes owed.

As the property owner at the time of auction, you can file a claim for your money to be returned to you.

After all active liens have been fulfilled or expired you are the rightful owner of the funds.

Why was I never told?

Notice of these funds are sent to the last known address of the owner who lost the property.

If the last known address is the property you lost the remaining funds will be left unclaimed.

Where can I find my rights to surplus funds?

Universal Citation: GA Code § 48-4-5 (2022)

If there are any excess funds after paying taxes, costs, and all expenses of a sale made by the tax commissioner,

tax collector, or sheriff, or other officer holding excess funds, the officer selling the property shall give written notice of such

excess funds to the record owner of the property at the time of the tax sale and to the record owner of each security deed affecting

the property and to all other parties having any recorded equity interest or claim in such property at the time of the tax sale…

When do I get my money?

With the right documents you can petition the court for the money you are rightfully owed, just file a notarized claim.

After the snail’s pace of bureaucracy (60-90 days), funds are mailed to you!

What does that property have to do with me now?

As the property owner at the time of auction, you can file a claim for your money to be returned to you.

After all active liens have been fulfilled or expired you are the rightful owner of the funds.

Why do I need help claiming what is mine?

We offer a simple filing process for you, doing the leg work to provide record analysis,

local notaries, and the documents prepared and processed by our legal team.